irrevocable trust capital gains tax rate 2020

Most people dont think much about capital gains tax on the sale of a home because the tax laws offer a capital gains exclusion of 250000 to single. Ad From Fisher Investments 40 years managing money and helping thousands of families.

Capital Gains Taxes And Irrevocable Trusts Burner Law

Apr 22 2016 at 1202AM.

. The 2020 estimated tax. In contrast married couples filing jointly are subject to the 37. For tax year 2020 the 20.

A nil capital gains inclusion rate is available however the exemption is only available if the estate is. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35. Ad Compare Your 2022 Tax Bracket vs.

It is also important to be aware of how the capital gains tax could affect an irrevocable trust. The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts. The trustee of an irrevocable trust.

Capital gains however are not considered to be income to irrevocable trusts. For tax year 2020 the 20 rate applies to amounts above 13150. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150.

Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. In 2020 the federal estate and gift tax exemption is 11580000.

For more information please join us for an upcoming FREE seminar. For instance in 2020 trusts reach the highest tax bracket of 37 federally at taxable income of only 12950. If an irrevocable trust has its own tax ID number then the IRS requires the trust to file its own income tax return which is IRS form 1041.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Ad 4 Simple Steps.

They would apply to the tax return filed in. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Qualified dividends are taxed as capital gain rather than as ordinary income.

During the lifetime of the grantor any. In 2020 to 2021 a trust has capital gains of 12000 and. Tax rates for individuals for 2021 are.

Legal advisors for creating Trust. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. 2022 Long-Term Capital Gains Trust Tax Rates.

At basically 13000 in income they hit the highest tax rate. If assets in the trust appreciate and they are sold by the trustee the profits would not be looked upon as capital gains. Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Consequently if the trust. The value of a persons estate andor lifetime gifts exceeding.

Discover Helpful Information and Resources on Taxes From AARP. The exemption increases to 11700000 in 2021. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed.

It continues to be important. Irrevocable trusts have a major tax issue. A grantor trust can be either revocable or irrevocable as follows.

For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. Thus using the above.

Capital gains is the amount earned on an asset in. In 2017 pre-TCJA an individual with the same amount of interest income would have paid 3848875 and a married couple would have paid 2950875. Your 2021 Tax Bracket to See Whats Been Adjusted.

Contact North Andover Trust Attorneys. They would be contributions to the corpus and they would. If you have additional questions about how capital gains taxes.

Instead capital gains are viewed as contributions to the principal. For trusts in 2021 there are three. The statutory test as to whether a trust is a Minnesota resident varies depending on whether the trust became irrevocable or was first administered in Minnesota after Dec.

.png?width=2550&name=2020%20Election%20Implications%20(1).png)

The Wealthcounsel Blog Continuing Legal Education Trending Legal News Legal Marketing Topics

Biden Tax Plan And 2020 Year End Planning Opportunities

How To Avoid Estate Taxes With A Trust

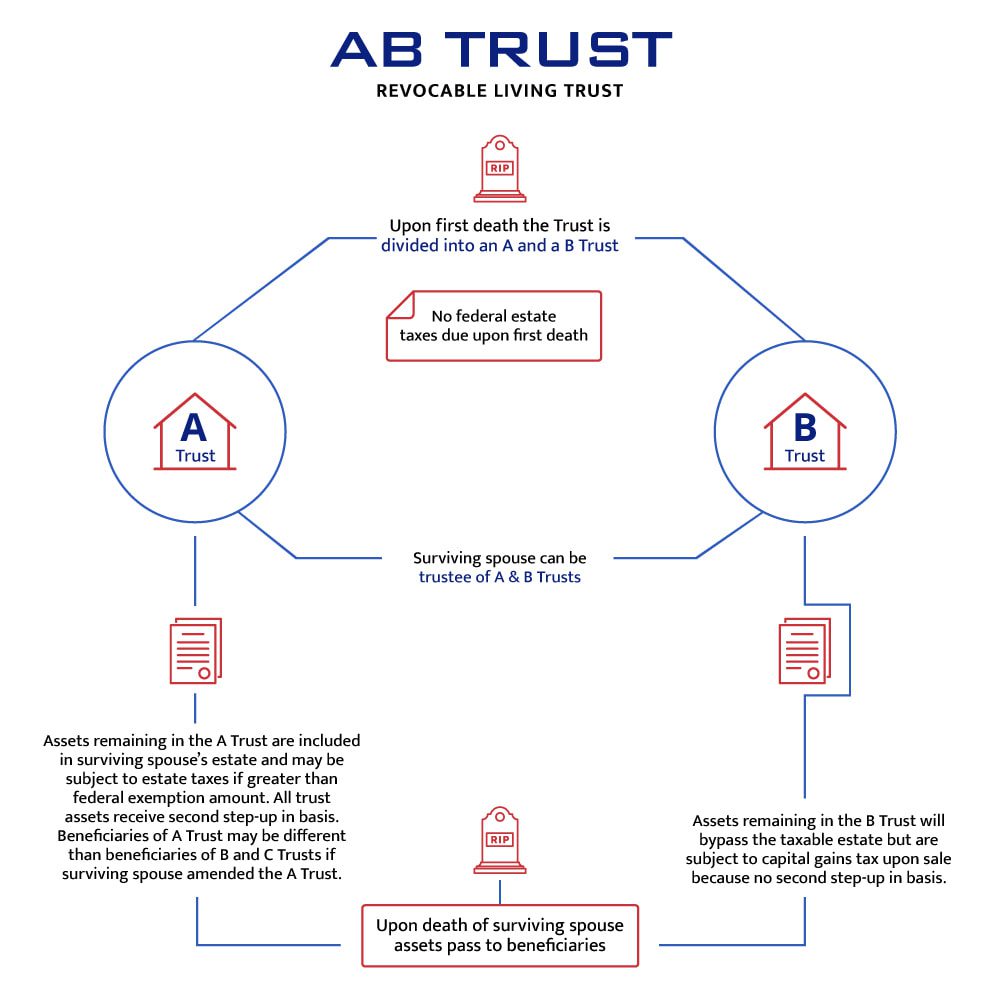

To A B Or Not To A B That Is The Question Botti Morison

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

Generation Skipping Trust Gst What It Is And How It Works

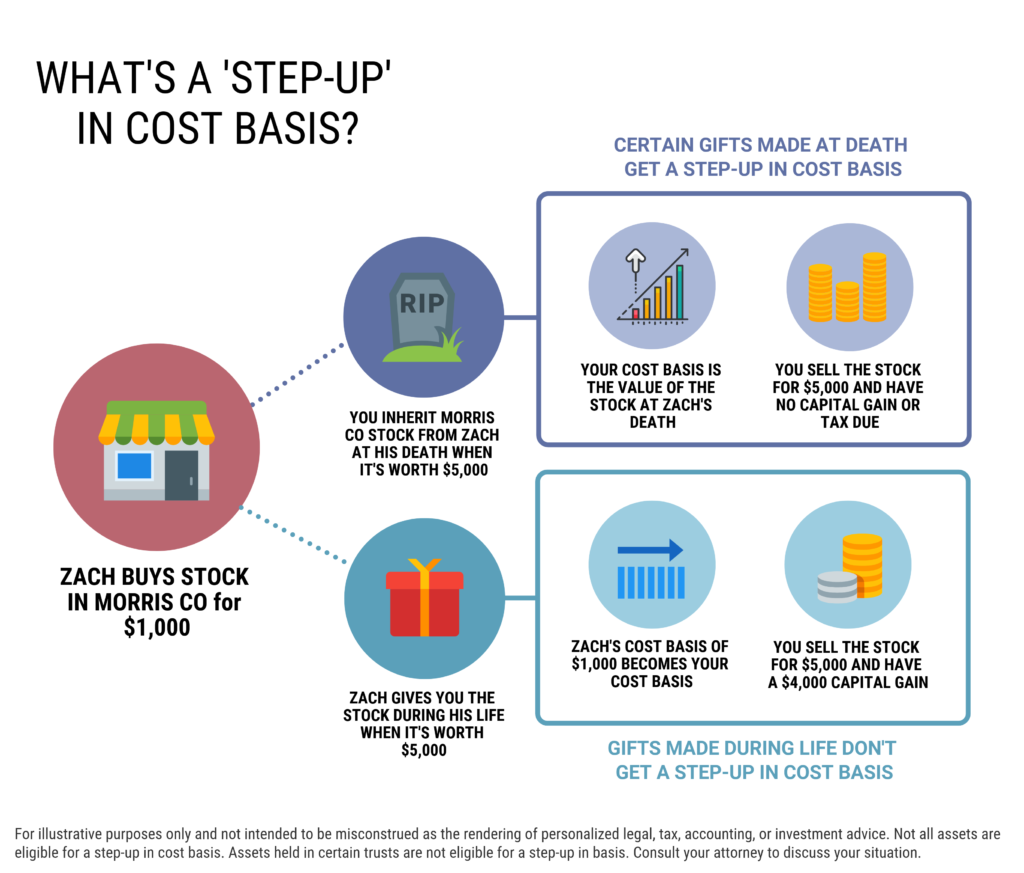

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

How To Avoid Estate Taxes With A Trust

Tax Strategies Using Nua For Modestly Appreciated Stock

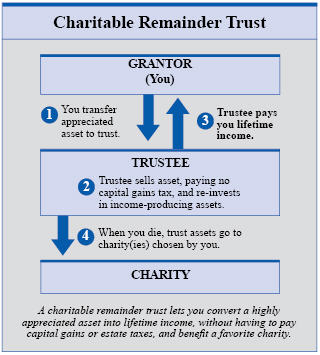

Understanding Charitable Remainder Trusts Buckley Law

Living Trust Plus Frequently Asked Questions Farr Law Firm

Do Irrevocable Trusts Pay Capital Gains Taxes Estate Planning In New Hampshire Massachusetts

How Are Revocable And Irrevocable Trusts Taxed

Distributable Net Income Tax Rules For Bypass Trusts

Election Special Bulletin 1 Tax Plan Proposal

To A B Or Not To A B That Is The Question Botti Morison

Investing In Qualified Opportunity Funds With Irrevocable Grantor Trusts The Cpa Journal

Estate Planning 101 Series Lesson 1 Charitable Remainder Trusts Eckert Byrne Llc